Nnamdi-Okonkwo-GMD-FBN-Holdings

Tussle over the soul of First Bank appears to be far from abating anytime soon, following the consequences of the supremacy battle between two giant money bags Femi Otedola and Oba Otudeko which continues to gear on.

Until the management tsunami in FBN Holdings in 2019 Oba Otudeko was Chairman of the company via his proxy Ibukun Awosika. However, the troubled billionaire was ousted in a properly calculated move believed to be backed by now embattled former Central Bank of Nigeria (CBN) Governor, Godwin Emefiele.

A First Bank insider account revealed what transpired, to ENigeria Newspaper, adding that Otudeko became too powerful and as well allegedly orchestrated some of the troubled loans awarded by First Bank in his days as Chairman of the bank.

A popular scenario was the problematic N75 billion loan facility by First Bank to Honeywell Flour Mills, a company in which Mr. Otudeko owns a majority stake among several other issues. The alleged insider lending said to be beyond the single-obligor limit, particularly for a director, called the bank’s corporate governance capacity to question at the time.

According to the account of Otudeko’s Honeywell Flour Mills in its press statement, the contentious loan was procured with collaterals at over 170% of Forced Sales Value (FSL), and 230% at Open Market Value (OMV), and had been performing from inception in accordance with agreed terms, however, Honeywell’s account contradicts the CBN’s assessment that the First Bank in what was largely considered inside conspiracy failed to perform its lien on Otudeko’s shares in the bank, which were placed as collateral for the loan.

Buttressing further, the CBN in a statement released to the media said, “We further noted that after four years the bank is yet to perfect its lien on the shares of Mr. Oba Otudeko in FBN Holdco which collateralized the restructured credit facilities for Honeywell Flour Mills contrary to the conditions precedent for the restructuring of the company’s credit facility”. For the records, a lien ensures the creditor (First Bank in this case) obtains the right to the property (Otudeko’s shares) if the borrower (Honeywell Flour Mills) fails to meet its debt repayment obligations.

Additionally going by a rough calculation at the time too, First Bank’s bad loan charges had ballooned by almost four times from N25.942 billion to N119.322 billion between 2014 and 2015.

The CBN then further called in Honeywell Flour Mill’s loan, adding that if the company is unable to pay up, Mr. Otudeko may lose his shares in the bank and it went ahead to eventually axe the Otudeko-led leadership of First Bank in 2019 when it dismissed the boards of the bank and its holding company, FBN Holdings, in a dramatic move that came a day after the bank appointed a new managing director. The regulator however reinstated the then forcefully removed former MD of the bank, Adesola Adeduntan.

The CBN’s intervention in the crisis saved First Bank a Systemic Important Bank (SIB) from a total implosion, and in achieving this, the apex bank wrote off over N150 billion in bad loans after shareholders failed to recapitalize the bank amid capital adequacy concerns.

Subsequently, the temporary leadership vacuum in First Bank following the CBN’s hammer, sending Otudeko packing ignited a battle between Femi Otedola and Hassan Odukale over control of the bank. Consequently, in 2021, Otedola emerged victorious having become the single largest shareholder in First Bank after acquiring about 5.07 percent stake in the bank.

In what has since been described by industry watchers as a commando move, Oba Otudeko made a systematic and strategic comeback in June 2023 after acquiring the largest share in First Bank in a cross-deal valued at N87. 8 billion.

The shares which Otudeko bought at N19 per unit are said to be the largest volume of First Bank shares traded in a single day since 2012 when the stock exchange started publishing data, according to a report by Arise News.

The move was considered to be too good to be true, as shareholders were thrown to discomfort over the validity of the trades considering that no single shareholder hitherto officially owned as many shares, and just like World War II, the battle between Otedola and Otudeko ensued.

ENigeria Newspaper reports that these series of battles between billionaire shareholders of First Bank has rubbed off negatively on innocent shareholders who decry their losses after several billion went down the drain following the recent collapse of FBN shares in the stock market.

Meanwhile, data obtained by ENigeria Newspaper indicates that the stock market performance of FBN Holdings has not been encouraging lately. This is as the company’s share fell to N19.80 kobo, from N21.5 kobo per share.

It was also learnt that the total market valuation of FBN Holdings fell to N710.72 billion from N771.74 billion earlier reported

Market expert’s observation revealed that the drop in FBN Holdings’ share value indicates a decline in the confidence of the stock market investors in FBN Holdings, due to the blurry future caused by the disagreement between the largest and other majority shareholders, as well as Otudeko’s court battle with Ecobank.

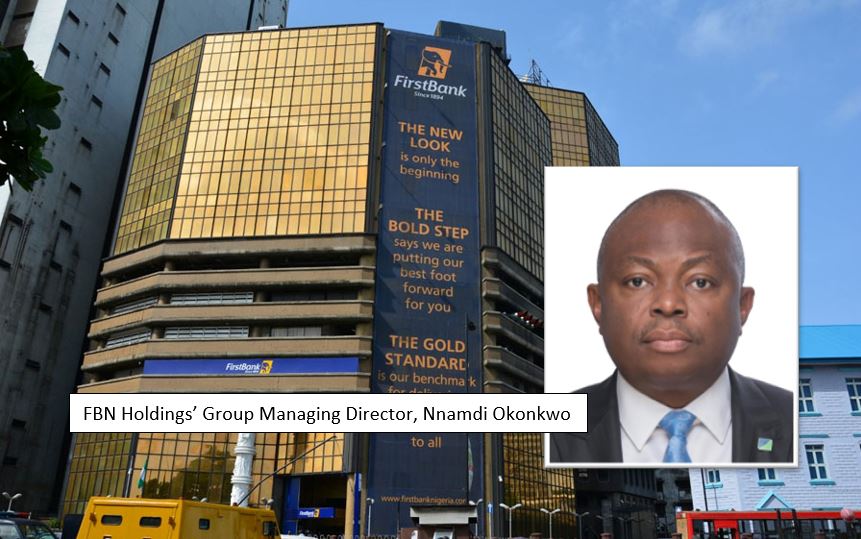

ENigeria Newspaper reports that Justice Nicholas Oweibo had on August 14 warned FBN Holdings’ Group Managing Director, Nnamdi Okonkwo, and other officials of the financial institution, not to disobey the order restraining it from holding its AGM.

The shareholders/applicants, in the suit, marked FHC/L/CP/1575/23, are Olojede Solomon, Adebayo Abayomi, and Ogundiran Adejare had initially approached the court to stop the proposed Annual General Meeting scheduled for August 15, 2023.

However, the court order was deliberately ignored by the Nnamdi Okonkwo-led, FBN Holdings which went ahead to hold its AGM as originally arranged on Tuesday.

ENigeria Newspaper reports that in section 133 sub-section 9 of the Criminal Code Act in Nigeria, any individual who, “commits any other act of intentional disrespect to any judicial proceeding, or to any person before whom such proceeding is being had or taken, is guilty of a simple offense and liable to imprisonment for three months”.

In view of the above-cited code, the Federal High Court seated in Lagos on Wednesday was intimated of a case of outright disregard to that section of the law by Nnamdi Okonkwo and other officials of FBN Holdings, and the court adjourned till August 23, 2023, to hear the motion seeking to commit all FBN Holdings Plc officials involved to prison for alleged contempt of court.

Punch Newspaper reports that in the motion filed by three aggrieved FBN Holdings Plc shareholders, it was alleged that the firm held its Annual General Meeting on Tuesday, despite an order of the court specifically restraining it from proceeding with the AGM.

It would be recalled that Justice Oweibo, in a sister suit filed by an aggrieved shareholder of FBN, Olusegun Onagoruwa, granted an application seeking substituted service on Okonkwo, and two other directors of the bank over alleged contempt in a case filed against them by an aggrieved shareholder of FBN, Olusegun Onagoruwa.

Aside from Okonkwo, other alleged contemnors are the Chairman of the Board of Directors, Alhaji Ahmed Abdullahi, and Non-Executive Director, Mr Julius Omodayo-Owotuga.

Justice Oweibo granted the application after hearing arguments from human rights lawyer and Senior Advocate of Nigeria, Ebun-Olu Adegboruwa, on behalf of the petitioner, Olusegun Onagoruwa, an aggrieved shareholder of FBN Holding Plc.

Meanwhile, FBN Holdings Plc has denied receiving a court order stopping it from holding the AGM scheduled for August 15, 2023, and insisted that the AGM would go as scheduled.

The company disclosed this via an official statement signed by Company Secretary, Adewale Arogundade, which was sent to Nigeria Exchange Limited.

According to the company, they haven’t been served with any court order to stop the AGM from holding.

When the matter came up on Wednesday, counsel for the plaintiffs, Dr. Muiz Banire (SAN) informed the court that the defendants were “in flagrant disobedience” of the court order.

He stated that an affidavit of facts stating the particulars of the disobedience had been filed.

But FBN’s counsel, Mutalubi Adebayo (SAN), informed the court that he had filed a motion seeking to discharge the order.

Adebayo, a former Oyo State Attorney-General and Commissioner for Justice, prayed the court for an adjournment.

Another counsel, Ebu-Olu Adegboruwa (SAN) also filed a motion for joinder as co-plaintiff to ventilate the rights of his client, who had a similar complaint.

However, Justice Oweibo adjourned the case to August 23, 2023, for the hearing of the motion for disobedience.

Meanwhile, the Central Bank of Nigeria has approved the appointment of billionaire investor, Femi Otedola, as a non-executive director on the board of FBN Holdings.

This was disclosed in a corporate notice filed by the lender to the Nigerian Exchange Limited on Wednesday.

Shareholders of the financial institution on Tuesday at its 11th Annual General Meeting endorsed Otedola’s appointment as well as that of the Executive Director, Finance, Investment Management and Oversight, Samson Ariyibi.

While Otedola was appointed on July 9, 2023, Ariyibi had been appointed on August 16, 2022. His appointment was approved by the CBN on October 21, 2022.

Otedola in late 2021 acquired a 7.6 per cent interest in the financial services group. He displaced Tunde Hassan-Odukale to take the lead position but now holds a 5.57 per cent stake according to the unaudited report of the lender for the first half of 2023. Hassan-Odukale interests stood at 4.4 per cent at the end of the same period.

Meanwhile, the acquisition of 4,770,269,843 shares of the company’s issued share capital of 35,895,292,791 by its former Chairman Oba Otudeko, had led to a tussle for control of the group.

Otudeko acquired the shares via a company, Barbican Capital, where two of his children have controlling interests.

The shareholders also approved the holding company to raise N150 billion in additional capital for future expansion. The capital raise will be via a Rights Issue.

In an effort to get the lender’s reaction to the uncertainties as well as other issues preceding the Bank’s AGM, ENigeria Newspaper reached out to Mr. Ismail, Head of Media Relations of First Bank and Chinwe Bode-Akinwande a member of the bank’s Corporate Communications department on August 10, 2023, as at the time of publishing this report, they were yet to respond to our enquiries.

Facts have emerged on how staff of First Bank led by businessman, Femi Otedola reportedly…

Trial in the alleged N5.8 billion Universal Basic Education Board fraud case of past Governor…

This is the biography of Lady Ada Chukwudozie, Chairman of Keystone Bank and Executive Director…

A major wave of defection has hit the ruling All Progressives Congress (APC) in Kaduna…

In a landmark ruling on Monday, March 10, 2025, the Supreme Court of Nigeria dismissed…

Otedola Bridge inwards Lagos witnessed a massive fire last night causing heavy gridlock and leaving…