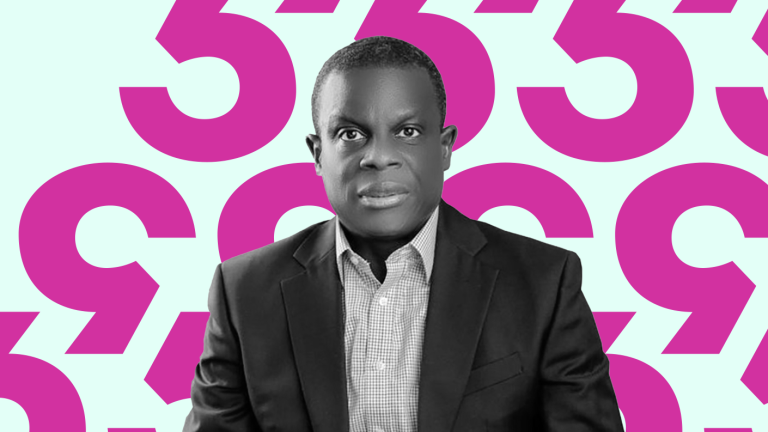

More facts are beginning to emerge on the real reason behind the exit of Olu Akanmu from the Chinese Fintech Company Opay, ENigeria News reports.

You would recall that in a publication on our online platform in 2023, ENigeria News reported that Olu Akanmu, a financial industrial veteran announced his resignation via his official Twitter handle calling for a need to do more to get more Nigerians financially included. READ IT HERE

While Akanmu failed to state the reasons behind his sudden resignation, it came across as a shock to many especially given that the fintech company is celebrating its 5th anniversary in Nigeria.

However, in a recent publication by TechCabal, “A clash of vision between the former banker and the rest of the company’s leadership led to Akanmu’s departure”, one person with knowledge of Opay’s business revealed.

“All the Chinese cared about are numbers much more than the brand’s perception and values,” the source revealed.

Several of Akanmu’s proposed initiatives, such as a payment gateway and a “payme” account for one-time payments, were reportedly shelved. Additionally, his commitment to social responsibility projects like financial inclusion for women and partnerships with internally displaced persons (IDPs) seemed at odds with the Chinese investors’ laser focus on numbers. Akanmu’s exit underscores the potential tensions between financial goals and brand perception in fintech companies.

Opay operates a co-CEO structure, giving Olu Akanmu and a second CEO internal sources identified as Steven dual leadership. According to those people, Steven was generally in charge of the policy at the fintech. Akanmu’s background in retail banking at FCMB, a Nigerian bank with a market capitalization of ₦217 billion, positioned him to develop Opay’s merchant business, including POS, agency banking, and wallets. Despite this focus, internal sources said his co-CEO, Steven, had greater control over Opay’s direction.

Opay did not answer any of TechCabal’s questions at the time of this report.

During Akanmu’s time at Opay, the fintech grew exponentially, reaching over 30 million users, 500,000 agents, and 100,000 merchants, according to publicly released figures.

The fintech previously offered a super app model, offering food delivery, ride-hailing, logistics, and payment services, before solely focusing on financial services in 2020. It also proved a formidable alternative to legacy banks during Nigeria’s botched currency redesign, which led to a cash crunch. The fintech’s robust infrastructure and effective distribution strategies were deeply attributed to this win.

New Leadership and regulatory hurdles…

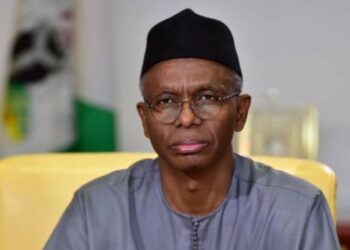

Following Akanmu’s departure, Daudu Gotring, a former director at the Central Bank of Nigeria (CBN), became CEO. This appointment signaled Opay’s attempt to navigate increased regulatory scrutiny surrounding its Know Your Customer (KYC) measures.

Opay faced increasing regulatory scrutiny over its Know Your Customer (KYC) processes last year after allegations that it opened accounts for users without consent. The fintech, alongside other neobanks, had simplified user registration to attract unbanked customers, sometimes omitting strict identity verification for basic accounts account types with limited features. Bad actors have exploited this lax KYC approach to perpetrate fraud.

For instance, Fidelity Bank, a Nigerian commercial bank, blocked transfers to OPay and other neobanks over concerns that their lax KYC processes are leading to increased fraud cases.

Source: ENigeria News