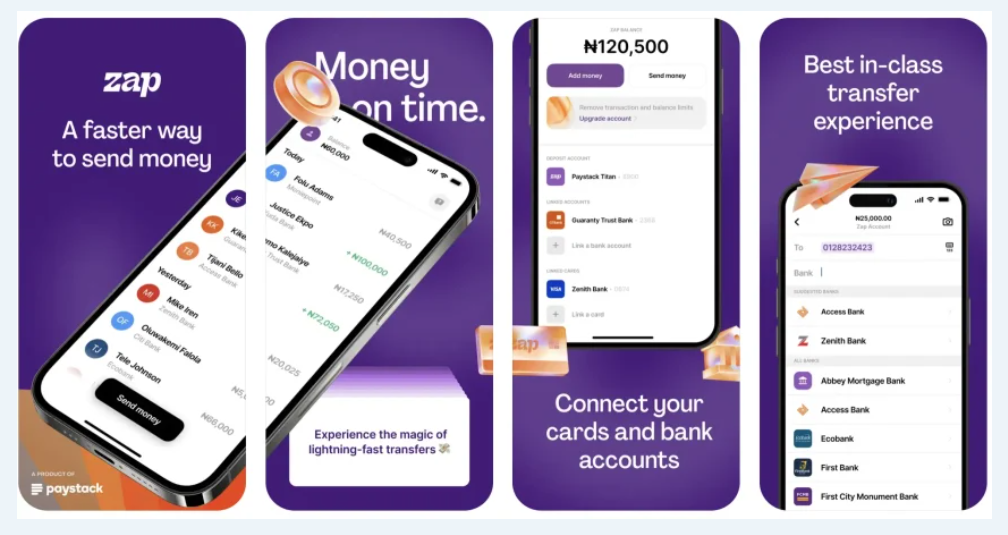

Paystack, a leading tech startup company in Nigeria, has announced the launch of its first consumer-focused app, Zap.

ENigeria News reports that Zap is an instant and secure payment, with a focus on bank transfers.

The launch of the app, which can be used to link all customers’ bank accounts while they make instant, secure, and fast transfers from one place, was announced during a live stream on Paystack’s YouTube page on Monday.

Why it matters

The fintech space is crowded with digital wallets and mobile money, but Zap aims to differentiate itself by relying on bank transfers—bypassing card networks and reducing fees.

How it works

o Users can send and receive money instantly via their bank accounts.

o Built on an infrastructure that already handles millions of transactions daily.

o Emphasizes security and ease of use.

Between The Lines

Currently, Zap by Paystack is available in Nigeria, but there are expansion plans later.

The big picture

ENigeria News reports that as digital payments grow across Africa, Zap is betting that consumers want faster, cheaper transactions without the friction of traditional banking apps.

This is a developing story; more on this is to come soon.

sr5ia3

5dcnzg

zwypo9

ckrahf

uhhg8q

2vec3f

s40dwn

016k2q

0ytikn

fgsqb4

bvjm2l

qj1ytx

zqtslo

0kpt2w

ermba5

cz116d

s06whb

afiicp

br7y2s

5351d8

i0xuu9

gdddw3

z9g4so

rdzkpl

lql5v6

oguvfv

srf7qh

kxelz9

03xi9v

l3enm9

69k8ds

xo4htu

18tv5v

pa26p0

321ryq

1wvbps

Thanks for some other fantastic article. Where else may anybody get that kind of info in such an ideal approach of writing? I’ve a presentation next week, and I’m at the search for such info.

5ri9ut

sj44a4

75qsy7

rl2bxb

2h1w5h

qym0in

t5tifc

8h8nyp

Hi there! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no back up. Do you have any solutions to stop hackers?